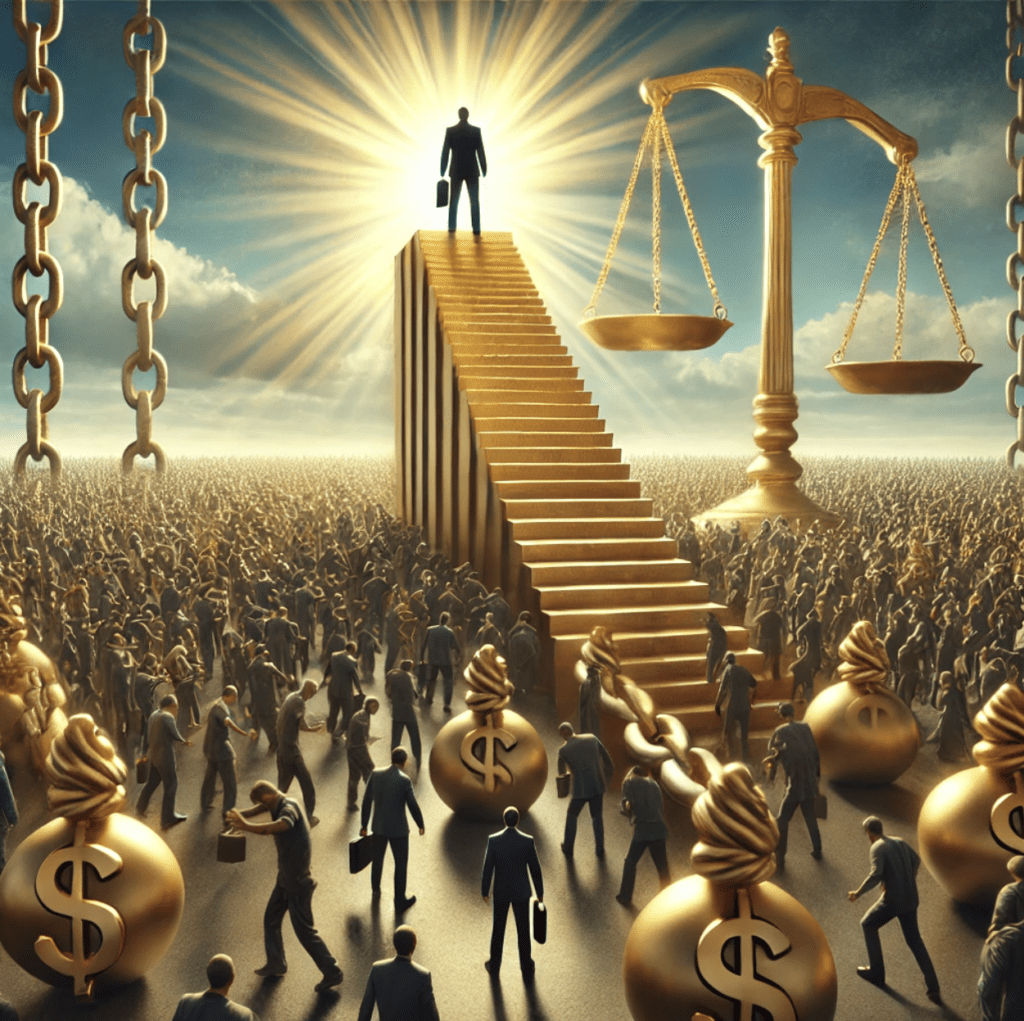

Financial freedom is the ultimate dream.

Many strive for it, but few attain it.

The sad reality is that 95% of people will never experience true financial independence.

They will spend their lives:

- Working for someone else

- Living paycheck to paycheck

- And never breaking free from the invisible chains of financial stress.

But it doesn’t have to be that way.

By understanding the key factors that separate the financially free from the rest, you can position yourself to be among the elite minority who do achieve financial freedom.

So, what holds the 95% back?

Why do so few make it to the promised land of wealth and freedom?

And more importantly, how can you become part of the few who rise above?

Let’s dive in.

The 5 Core Reasons 95% of People Will Never Achieve Financial Freedom

1. A Lack of Financial Education

Most people are never taught how to manage money properly.

They grow up being forced to memorize useless fluff but are rarely, if ever, taught financial literacy.

- Making

- Saving

- And investing money

most are left with only a superficial understanding of how money works.

They believe the pathway to financial success is through:

- Working hard at a job

- Collecting a paycheck

- And saving what’s left.

However, the problem with this approach is that it doesn’t account for:

- Energy

- Inflation

- Economic downturns

- Or the fact that time is a limited resource.

You can only trade so many hours for dollars.

In contrast, the top 5% understand that wealth is built through leveraging ownership of assets like:

- Stocks

- Real estate

- Businesses

- And intellectual property.

They prioritize financial education, constantly learning about:

- Investment strategies

- Tax planning

- And wealth-building tactics.

They know that working harder alone won’t cut it – working smarter is the key.

2. The Comfort Zone Trap

Most fall into the trap of comfort.

Once they secure a stable job with a decent salary, they stop pushing themselves.

They get comfortable with:

- The status quo

- Living for the weekends

- And paying their bills.

Financial freedom requires:

- Taking risks

- Stepping out of your comfort zone

- And embracing uncertainty.

The 95% prefer the illusion of safety that comes from a predictable routine, but the truth is, there is no safety in being stuck.

Job security can disappear overnight, and a stagnant salary barely keeps up with the rising cost of living.

On the other hand, the 5% embrace discomfort.

They understand that growth only happens through pressure.

Whether it’s:

they’re always willing to push boundaries to create more opportunities for financial growth.

3. A Consumer Mindset

The average person has a consumer mindset, focused on spending instead of investing.

They prioritize instant gratification – buying:

- The latest gadgets

- Clothes

- Cars

- And vacations

without considering the long-term consequences of their spending habits.

Financial freedom doesn’t come from making more money alone – it comes from how you manage the money you already have.

The 95% live paycheck to paycheck because they’re stuck in a cycle of consumption.

They accumulate liabilities, not assets.

Instead of buying things that appreciate in value, they spend on items that lose value the moment they leave the store.

The 5%, however, have an investor mindset.

They know that every dollar has the potential to be a tool for wealth creation.

Rather than spending recklessly, they channel their income into assets that generate income and appreciate over time.

They prioritize building wealth over showing it.

4. A Short-Term Focus

The vast majority are stuck in short-term thinking.

They focus on immediate needs and desires, never planning for the future or considering the long-term impact of their decisions.

Whether it’s not investing in retirement or avoiding taking risks that could pay off in the future, their perspective is narrow.

Financial freedom requires long-term thinking and delayed gratification.

The 5% understand that real wealth isn’t built overnight.

They are willing to sacrifice comfort in the present for financial abundance in the future.

They have the discipline to save and invest consistently, knowing that the compounding effect of their efforts will pay off exponentially over time.

5. Failure to Build Multiple Streams of Income

Most people rely on a single stream of income, typically from their job.

While this may provide security in the short term, it’s also incredibly risky.

If that one source of income dries up, they’re left with nothing.

True financial freedom requires running it up, then diversifying your income sources.

The 95% live under the illusion that one job will take care of them for life, but the reality is that jobs are temporary, and relying on one paycheck is dangerous.

They get trapped in the “rat race,” trading time for money with no exit strategy.

The 5% know that the secret to wealth is in building multiple streams of income.

Whether through:

- Investments

- Side hustles

- Real estate

- Or owning businesses

they diversify their income so that they’re not reliant on any one source.

This allows them to weather financial storms and continue growing their wealth regardless of what happens in the economy or job market.

How to Be One Of The Few Who Achieve Financial Freedom

Now that we’ve covered why 95% of people never reach financial freedom, let’s look at how you can ensure that you’re part of the few who do.

Here are actionable steps to shift your:

- Mindset

- Habits

- And strategy

toward financial independence.

1. Invest in Financial Education

The first step to financial freedom is becoming financially literate.

This doesn’t mean you need a degree in finance, but it does mean that you should commit to learning about:

- Money management

- Investing

- And wealth-building.

Read books, attend seminars, listen to interviews, and find mentors who can help guide you on your journey.

Knowledge is power, and when you understand how money works, you’ll be able to make smarter decisions that lead to long-term wealth.

2. Develop a Growth Mindset

Financial freedom is as much about mindset as it is about money.

You need to cultivate a growth mindset – one that:

- Embraces challenges

- Learns from failures

- And believes in the potential for constant improvement.

Recognize that setbacks are part of the process and that every obstacle is an opportunity to grow.

3. Master the Art of Delayed Gratification

You have to be willing to sacrifice short-term pleasures for long-term gains.

This means:

- Curbing unnecessary spending

- Avoiding consumer debt

- And prioritizing saving and investing.

Learn to live below your means so you can invest the difference in wealth-building assets.

Delayed gratification is one of the key traits that separate the 5% from the 95%.

It requires discipline, but the rewards are well worth it.

4. Build Multiple Streams of Income

Don’t rely on a single source of income.

Start building additional streams, whether through:

- Investments

- Real estate

- A business

- Or freelancing.

The more assets you have, the more secure your financial future will be.

5. Take Calculated Risks

You can’t play it safe if you want to achieve financial freedom.

This doesn’t mean you should gamble with your money, but it does mean you need to take calculated risks.

Whether it’s:

- Investing in a new business

- Entering a new market

- Or acquiring an asset

being willing to step outside your comfort zone is critical to building wealth.

Final Thoughts: Make the Choice to Be One Of The Few

The truth is, most won’t achieve financial freedom.

But that doesn’t have to be you.

By:

- Investing in financial education

- Adopting a growth mindset

- Mastering delayed gratification

- Building multiple streams of income

- And taking calculated risks

you can become one of the few who live life on their terms.

Financial freedom isn’t just about money – it’s about:

- Control

- Choices

- And living life on your own terms.

It’s about breaking free from the constraints of the 9-to-5 grind and creating a life where your time is your own.

So make the decision today to start doing what 95% of people won’t – so you can live the life they can’t.

You May Also Like:

Inside: The Biggest Challenge In Online Business (And How To Master It)

7 Business Principles David Ogilvy Used To Build A $864 Million Empire

Billionaire Warren Buffett Says This Common Habit is What’s Stopping You from Becoming Rich

7 Businesses You Can Start With $0

10 Outrageous Habits of the Wealthy - and How You Can Steal Them

Exclusive Millionaire Success Stories: Gas Station Tycoon

The Wealth Trap: Why Financial Literacy is Essential for Retaining Wealth

Wealthy Mindset Secrets - The Best Money Advice I Ever Got

My name is Mister Infinite. I've written 701+ articles for people who want more out of life. Within this website you will find the motivation and action steps to live a higher quality lifestyle.